Let’s get the facts out there. We are living in a connected world. From our security cameras, our smartwatches, our blood pressure, and glucose monitors, our connected cars to even our smartphones that track, measure and analyze our way of life. For work and leisure alike.

In 2010 people owned 12.5 billion networked devices and by 2025 that figure is projected to reach a staggering 50 billion. Source: McKinsey & Company

Naturally, the growing number of connected devices and smartphones are disrupting the existing business models and solutions for Insurance providers. In this article, we look at the top 3 key insurance types and the possible solutions and strategies that the combination of iOT and Mobile present.

Health Insurance

Insurers are growing keen to know more about our health and vitals data – both present and historic; to define their policies and offerings. The challenge that they faced all the yesteryears was that they had to rely on a medical fitness test to either approve or reject a prospective customer’s insurance proposal. And then there was data darkness.

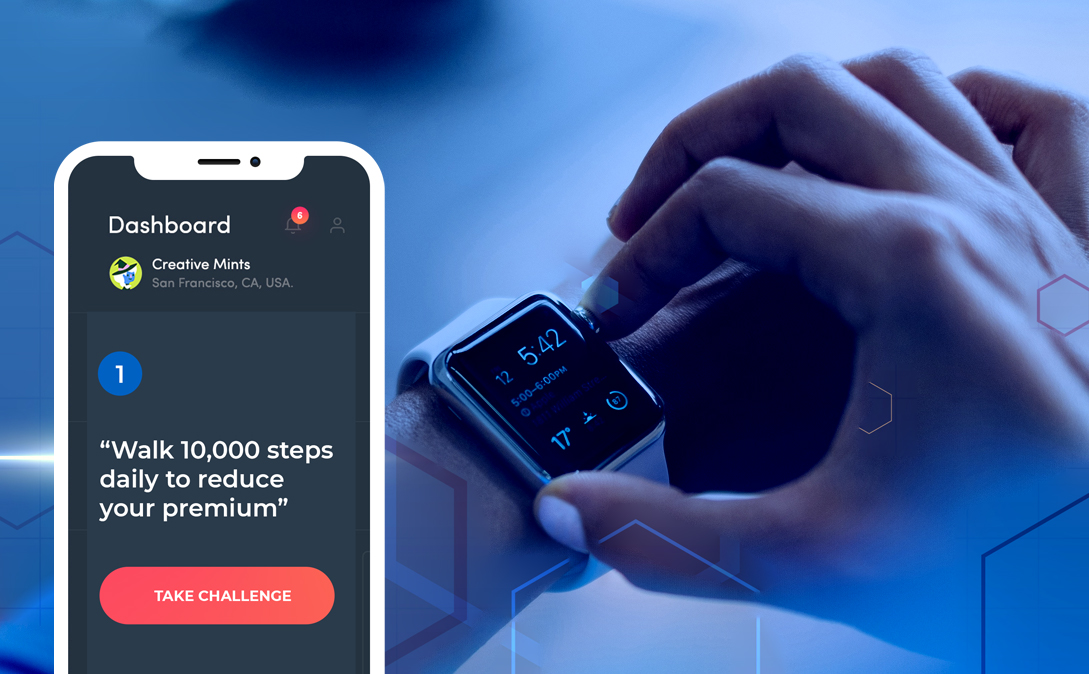

But we as a modern society of health-tech savvy, Fitbit sporting generation have been collecting data for years in our mission to stay fit. Our smartwatches, our glucose monitors, our sleep and walk trackers have been generating volumes of health data for us. And with R&D and focus on native platforms from Google (Google Fit) and Apple (Health Kit) we are syncing up our data under centralized secured data insights.

And even if you don’t want to share your data with Google or Apple, your insurer can request them directly within their mobile apps.

Some innovative mobile strategies like

- “walk 10,000 steps daily to reduce your premium”,

- “challenge your friend for a run and win a prize”,

- “log your glucose levels daily and boost your cover limit”

have proved to be a benefit for both the policyholders and the insurers.

Insurers have realized the mantra of “Prevention is better than Cure”. If their policyholders live a healthier life, they are more likely to have fewer hospital visits and in turn have lesser insurance claims.

Insurers are using these kinds of data insights within their Mobile Apps to adjust insurance premiums, up-sell bonus add-ons and provide alerts and notifications for better well-being of their customers.

Vehicle Insurance

Automobiles had computers running their onboard diagnostics for a decade or more now. But like our fitness trackers, our vehicles are now connected to the grid and are generating diagnostics and usage data like never before that we are getting access to. And these apply to both private and commercial vehicles.

89% of all new cars sold by 2024 will have embedded connectivity and 78% of car owners will demand connected services in their next vehicle.

A typical owner of a Ford F-150 spends $1,890 annually for insurance, part of a “value chain” that amounts to $7,000 per year for gas, maintenance, tolls, and other costs, according to a recent presentation from Ford connectivity and emerging services global director Mike Tinskey.

What would happen when the sensors, OBD, and other data-collecting and data-transmitting technology installed by the OEM present insights to the Insurer? Insurance discounts are coming!

A driver whose data shows him to be safe and cautious might end up paying a lower premium than someone who turned out to be using the gas pedal aggressively as he speeds through a school zone.

But what about mobile? Mobile will play a direct advantage to the driver here, presenting him with insights from his vehicle telematics to do a course action before the insurance bills get mounting.

The connected car ecosystem, telematics, and mobile are going to help Insurers up-sell services, reduce accidental claims and offer preventive solutions on the road.

Home and Property Insurance

The connected home is a dual benefit for both the Insurer and the Insured. Smart home sensors will alert the homeowner and the insurance provider via their connected mobile solutions about a roof that is about to fall before it falls. And in turn, the homeowner can either take action beforehand and claim lesser insurance or in adverse negligence, the insurer can bring down the valuation of the house and thus gaining premium upsell.

Connected homes will also generate data and insights which can power personalization services on the insurer’s mobile app.

And with this data being in the future on Blockchain and Distributed Ledgers, mobile claim processing and handling will be faster than before.

The same principles will not only apply to our Condos and Apartments but also to Large Industrial Warehouses and Factories fitted with Insurer approved IoT devices and mobile apps solutions. Insurers will have to re-evaluate their IoT based mobile strategy for both Retail and Enterprise Customers.

Conclusion:

IoT enabled Mobile Strategy for Insurance is in an interesting space right now.

Key steering factors will depend on device & platform ecosystem, data control & access and the overall ecosystem of users willing to let Insurers use their connected data to personalize their offerings on them-Insurance apps. But the biggest benefit of this disruption will go to the early adopters and the innovators in the Insurance industry. And the ones who delay their decisions will surely miss the bus!

Looking for a Strategic Digital Transformation Partner?