According to a survey by Nvidia 91% of financial services companies are driving critical business outcomes with investments in AI. Machine learning in finance, a key AI technology, aims to build error free models to automate processes and change the trend in traditional banking and trading practices.

Why use machine learning in finance and banking?

Companies are turning to machine learning use cases in finance for stronger security, slicker user experience, faster support, and nearly instant gapless processing.

The potential benefits of AI and analytics for global banking are so great that they could generate up to $1 trillion in value annually, according to McKinsey.

Some of the potential benefits that machine learning have to offer for banking are:

Improved decision making

By contrast to conventional approaches, artificial intelligence enables banks to accurately determine credit scores through its bias free assessment. Machine learning analyzes a pool of data about potential borrowers aiding banks in improved decision making.

Better risk management

Machine learning facilitates the early identification of errors and the anticipation of potential future risks enable the banking industry to proactively prepare for them.

Transaction history is leveraged to make predictions once credit is extended to customers. This empowers employees with greater insights into credit risk assessment.

Prevention of fraud

The banking industry faces a substantial challenge with credit card fraud. However, the integration of machine learning can effectively reduce the occurrence of fraudulent activities. A significant portion of fraud incidents takes place during customer transactions, whether conducted online or offline.

Machine learning in banking addresses this issue through various preventive measures. For instance, facial recognition technology can be employed to verify the identity of the credit card owner during a transaction, ensuring a higher level of security.

Improved customer experience

As technology continues to revolutionize various aspects of life, consumers increasingly seek enhanced services and expect the same from banking institutions.

Machine learning plays a crucial role in enhancing the overall banking experience and services by significantly reducing the time required for credit decisions and other banking operations. What used to take weeks, such as loan applications, can now be completed within days. Machine learning enables an unbiased analysis based on multiple credit factors, further enhancing the efficiency and accuracy of decision-making processes.

Changing internal operation solutions

The implementation of machine learning in the banking sector has brought about significant positive transformations in internal operations. Automation plays a crucial role in reducing the time spent by staff on repetitive tasks, allowing resources to be directed towards enhancing the overall banking experience.

By swiftly navigating through customer databases, ML models streamline processes that would otherwise require manual intervention from employees. This not only saves time but also reduces the dependency on human resources for such tasks.

New marketing and lending solutions

Machine learning (ML) and artificial intelligence (AI) in fintech collect data and identify patterns that help banks make better marketing predictions. For example, ML can be used to predict:

- Changes in currency values

- The best investment opportunities

- Credit risks

- The optimal loan terms for a client

This data can help banks make more informed decisions about where to invest their resources, which can lead to increased revenue. It can also help banks target their marketing efforts more effectively, which can attract new clients.

Customization

ML offers significant advantages to banks by enabling effective organizational management, improving customer satisfaction, and facilitating personalized and streamlined operations and support.

The utilization of big data empowers banks to deliver personalized experiences to their clients and potential customers within the banking sector. The implementation of ML in the banking industry revolves around the objective of establishing secure yet easily accessible financial services and data.

Use Cases of Machine Learning in Finance

Machine learning finds several path-breaking implementations in financial processes like credit scoring, onboarding and documentation, fraud detection, algorithmic trading.

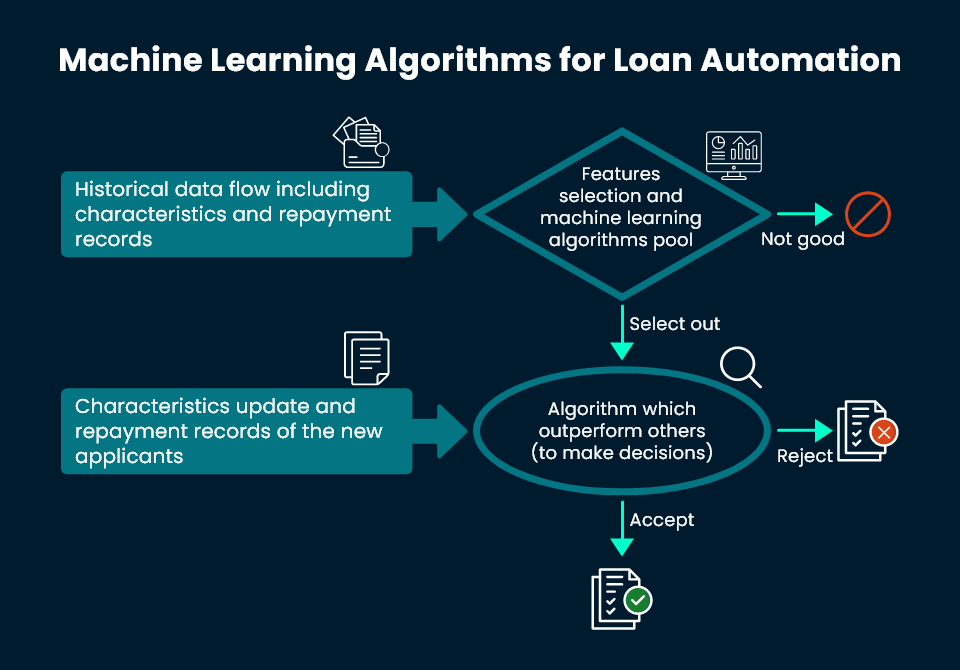

Credit scoring

Machine learning in credit scoring can crunch through millions of data points, transaction details, and behavior patterns to determine hidden features about consumers. As a result, machine learning models can generate highly personalized offers that boost revenue by catering to more customers, such as those thought to be credit invisible.

Unlike human credit scorers, machine learning algorithms based on statistical and accounting principles can evaluate borrowers objectively without emotion or biases. Understanding the unbiased risks enables banks to make better decisions and serve a wider audience.

Credit scoring is one of the most useful applications of machine learning in FinTech.

Machine learning use cases in finance give lenders better insights into a borrower’s ability to pay by working with far more data and more complex calculations than conventional models. Machine learning processes more layers of data, and isn’t limited to FICO scores and income data. Such applications of machine learning in finance open alternative data sources to lenders.

Machine learning processes more layers of data, and isn’t limited to FICO scores and income data like conventional models. In fact, machine learning algorithms compare aggregated data points from thousands of factors such as data from social profiles, telecommunications companies, utilities, rent payments, and even health checkup records with those of thousands of other customers to generate an accurate risk score. If a risk score is under the threshold set by the lender, a loan will be approved automatically.

Onboarding and documentation

Document classification, for one, is a vital but traditionally labor-intensive process that requires considerable time and resources. Machine learning can significantly reduce the processing time for labeling, classifying, and organizing documents for later retrieval. Traditional documents can be run through OCR (Optical Character Recognition) process and then analyzed through ML algorithms to decipher the context of texts present in the scanned document. Using that information, the machine learning model can classify the document and index it for future search for ready access by company employees.

When machine learning is a part of the onboarding and document recognition processes, customers can complete complex operations such as opening a new bank account in minutes from anywhere and on any device. All checks can be carried out in real-time while the business effectively captures the data consumer inputs into the system. Such use cases for machine learning help companies build long-lasting and valuable relationships with their customers.

Fraud detection

Machine learning fraud prevention is among the most effective applications of technology to date. Dedicated innovative algorithms analyze millions of data points, transaction parameters, and consumer behavior patterns in real-time to detect security threats and potential fraud cases. Unlike traditional static rule-based systems that apply the same logic to most consumers, machine learning fraud prevention is personalized on a customer-by-customer basis.

Fraud detection also helps in preventing false positives. Financial institutions suffer greatly from false-positive card declines because they risk losing their consumers’ loyalty if a business wrongly rejects their cards.

Algorithmic trading

Algorithmic trading fused with machine learning ushers in a new era of technical innovation. ML models closely monitor financial news, trade results, prices, and hundreds of other data sources simultaneously to detect patterns that move the prices of financial instruments. The models can then automatically place bids at the best possible positions with much precision avoiding manual errors that may lead to millions in losses.

Automated robo-advisors driven by ML algorithms can make investment decisions automatically based on a customer’s risk profile and preferences. They can build and manage personalized portfolios to help consumers achieve their investment goals. This in turn offers personalization to customers and builds a better customer relationship.

Conclusion

Over the years, financial institutions will need to embrace machine learning to keep up with the changing trends. Machine learning revolutionizes the way financial institutions deliver solutions to their customers. By harnessing its power, companies can analyze vast amounts of data to gain deep insights that lead to informed decision-making and profitable investments. Machine learning algorithms identify patterns and make accurate predictions, enabling organizations to make strategic moves with confidence. Leveraging this technology will help to develop innovative products and services that precisely cater to the unique needs of banking and financial product customers and build stronger, more valuable relationships.